Cosigning a mortgage

At some stage in your life, you could decide to buy property which have a mortgage. Many mortgage brokers make the new homebuying process as smooth that you could, there might be a monetary roadblock in your stop one to suppresses you from handling the end line. Even though you’re in a great updates to place a down payment, pay the settlement costs, and consistently create monthly premiums, can you imagine you are not able to meet the requirements?

Fortunately, your house to acquire journey has no to quit loans Rockville around. For most homeowners, getting turned from a home loan pre-approval will be a discouraging roadblock when you look at the trying to secure their dream domestic. This will be on account of of a lot issues, and additionally bad credit, most other unsecured loans, and/or overall chance that the lending company sees out of your financial predicament. Before you can imagine your shed the vow, imagine that have someone cosign the borrowed funds.

So you’re able to cosign a home loan methods to signal the borrowed funds together having a new borrower. The fresh new cosigner performs the new judge duty to-be good backup origin for cost and you may part of when you’re unable to do their financial responsibilities. This notion have helped of a lot consumers reach homeownership that will make it easier to also.

Reasons why you should Cosign a mortgage

It is rather popular for loan providers to see borrowers cosigning on the that loan. Generally speaking, an excellent cosigner was a close friend or loved one of the debtor and that is permitting this person qualify for that loan when they don’t really qualify on their own. Cosigning a home loan isn’t really always requisite, but can be beneficial for the second causes:

- Assist an applicant obtain money

- Help an applicant build credit

- Lose financial exposure

A sensible exemplory instance of one of those reasons is a school student or current graduate who would like to buy however, has minimal credit rating and no money. The latest student’s moms and dads are prepared to cosign towards the mortgage as it could be a sensible resource and they have the income and you will borrowing expected to have the mortgage acknowledged. Within situation, the parents don’t need to inhabit our home and you can in the event the its money can also be keep the mortgage certification, we are not expected to document people money in the beginner.

Exactly what do I want to Begin?

While the occupying debtor, you can aquire been to the software techniques as though you were to locate a home loan your self. The brand new cosigner might possibly be handled the same as almost every other mortgage candidate. Based on their home loan lender’s conditions, you will need to provide equivalent documents since occupying borrower, that could are:

- Application for the loan: The latest cosigner will done a software which provides the lender brand new cosigner’s a career and you will home history.

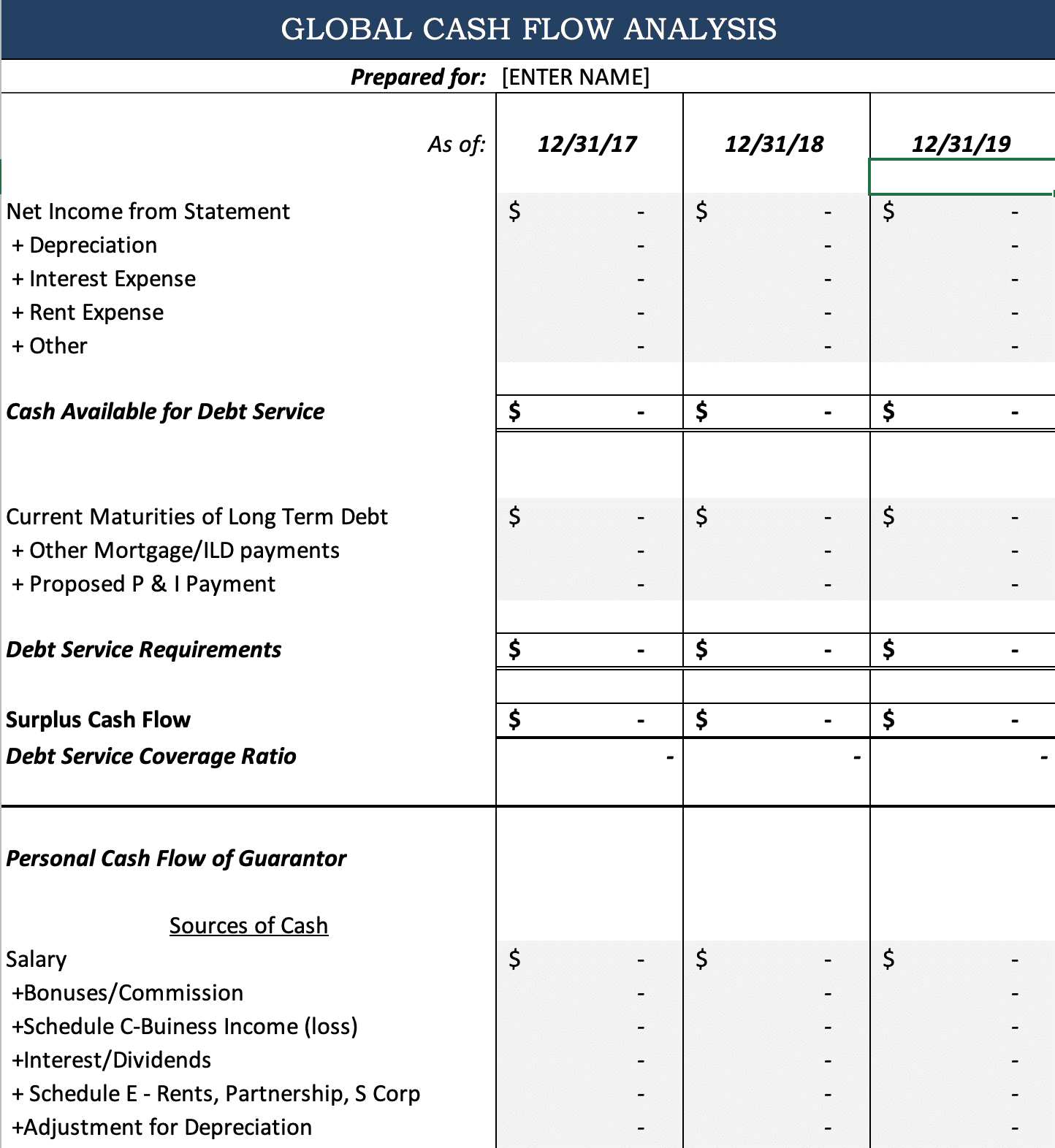

- Economic recommendations: The fresh cosigner should provide equivalent financial papers this 1 would-be necessary to submit for a financial loan software. These tend to be W-2s, taxation statements, paystubs, assets, and you may a credit file.

- Link to Cosigner: Based on your home loan company, you might be expected to describe your own relationship to brand new debtor. Specific lenders and software need to have the cosigner getting an almost relative rather than a pal. Ensure that you ask your mortgage lender its policy into the cosigners ahead of continuing toward app.

As these affairs merely security the basic standards, their bank could possibly get keep in touch with both you and the fresh cosigner to provide additional files otherwise make sure people registered pointers.

Why does Cosigning a mortgage Works?

Always, lenders first glance at the application and you will papers to your individual attempting to get or re-finance our home. If this ends up they won’t meet the requirements by themselves, a familiar option would be to inquire of if the a great cosigner are an option. If someone else are ready to cosign, the financial institution often request a software as well as the called for documents to verify the borrowed funds degree work which have both sides. They become familiar with the credit and you may income into the borrower and you will cosigner so the latest aggregate obligations and you will income away from each party fit in qualifying parameters. The financing score we uses in regards to our loan decision could be the straight down, center score ranging from both sides.