If you would like cash out your property security to blow out-of high-desire credit card debt, are the amount of personal debt you are paying off on the loan number, along these lines:

Take the latest home loan balance which you have. Today range from the mastercard balance you want to help you pay off. The fresh complete was split by the house really worth that it number can https://paydayloanalabama.com/white-plains/ be your LTV (loan-to-value ratio)

Eg, what if your current mortgage balance try $225,000 toward a house which is well worth just as much as $eight hundred,000, therefore must pay back $fifteen,000 inside credit card debt. Your formula carry out seem like that it:

Because your mortgage-to-really worth ratio try less than 80%, you’ll be able to re-finance and money aside adequate equity to expend from their personal credit card debt without paying having mortgage insurance! Inside analogy, it’s a sensible financial decision. Our very own subscribed loan officials can be remark a cash in the zero cost and help you make an educated choice that really works to have you.

Consolidate Obligations by Refinancing The Home loan

Its perhaps not a prudent economic decision to keep up balance toward large-interest financing otherwise handmade cards when you have the ability to refinance your home and you can combine their highest-desire obligations towards one to lowest payment per month when you’re paying less overall monthly. Together with, rather than credit card attract, the eye in your financial is sometimes tax-deductible, however, be sure to consult with your accountant to discuss questions.

Even although you don’t have primary borrowing, we could help! We really works directly with small and legitimate borrowing from the bank repair enterprises. Paying your own highest-attract expense quicker can also be considerably improve your credit score.

Should find out if you could reduce your payment per month and take cash-out to get into money for the most other expenses? Just click here today.

Do you enjoy combining a couple of mortgage loans? Within Residential Domestic Resource, we could help you refinance one another loans into the that which have an effective aggressive price that may notably lower your month-to-month homeloan payment. We’ve assisted Americans for more than 15 years lower their payment per month by the refinancing. Contact us today to observe how we could let!

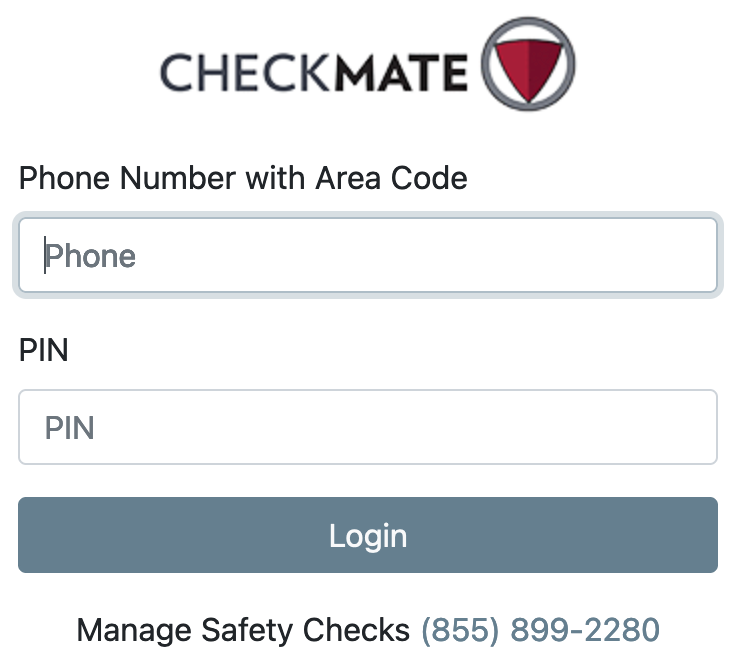

On RHF, you’ll receive a straightforward, simple and fast on the internet app techniques which have faster records. It permits you to join at any time and you will song the status of your own financial software.

Our home Mortgage Pros are available to answer your issues go out otherwise evening, which help you are aware the important points so you obtain the right personalized mortgage for you personally.

Preferred Loan Options for Merging Loans

Virtual assistant loan Pros and active army people is combine obligations having a decreased fixed speed and will simply take cash-out up to 100% of value of our home!

Faqs

More often than not, you are able to add the closing costs for the taking another type of financial on full re-finance total prevent investing things with your own money in the closing. Although not, refinancing to acquire cash out otherwise consolidate the debt will get impact in the a lengthier loan title or a higher rate, which you’ll imply spending far more when you look at the appeal full about long term.

Certain says has actually restrictions about in the future otherwise how many times the residents normally re-finance home financing. This type of limitations are built to ensure that the re-finance techniques gurus brand new resident. At the same time, we should make certain you are receiving qualified advice of an individual who is evaluate your financial situation and provide honest guidance. In the RHF, you to definitely individualized lending is really what i would finest.

If you find yourself struggling to pay the debts and you may feel just like you are overwhelmed because of the obligations, you are not alone. Discover many someone else in the same boat. For many people, a smart, customized loans administration combination program is the greatest answer for regaining power over the funds and you will strengthening a very good foundation toward upcoming.