- Are you 18 many years or earlier?

- Have you got a-south African ID?

- Can be your newest money steady?

- Can be your credit history healthy?

- Have you ever checked your own cost that have a free thread calculator?

- Whether you are care about-working otherwise a salaried personal, maybe you have wishing the paperwork needed for the mortgage software?

- Note: those who are care about-operating will demand additional documents away from whoever has an employer.

There are certain available options and then make qualifying for home financing into the Southern Africa possible, instead of a faraway fantasy. With this thought, its problematic to add the absolute minimum paycheck needed for an excellent mortgage in SA just like the creditors are prepared to give an amount borrowed that is regarding your income. The reduced your revenue, the low the mortgage count where you can be be considered. Your credit rating will gamble a huge part from inside the deciding how much cash a financial try willing to provide your. In most cases, don’t let yourself be using over a 3rd of your online monthly income towards your monthly thread money.

Normally, how much can i secure to pay for a mortgage?

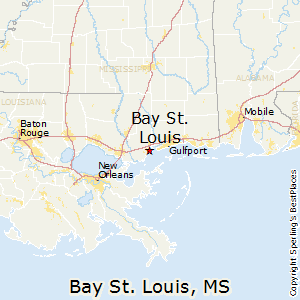

Once again, it is a tricky concern to respond to. But not, to offer a highly Bayfield loans harsh suggestion, it can be helpful to consider what households cost in the for each and every province and you may what income you would need to be eligible for toward a home loan of the same worthy of. Considering BetterBond study, so you’re able to qualify for a mortgage from equivalent value from the newest Finest speed out-of 9%, you’ll need to earn a terrible domestic earnings of your pursuing the from inside the for every state:

- Regarding the East Cape, the average price are R1,048,847 (the lowest priced of all Southern area African provinces), therefore you’ll need to secure at the very least R32,000 30 days to afford a mortgage of this really worth.

- On the West Cape, the common price is R1,778,806 (the most costly of your provinces), thus you’ll want to earn about R54,000 four weeks to pay for a mortgage regarding the worth.

- Inside KwaZulu-Natal, an average purchase price is R step one,482,625, thus you’ll want to secure no less than R45,000 30 days to cover a home loan associated with the value.

Any kind of government provides which will help myself?

To simply help first-day customers enter the property markets, a government-run bonus scheme is made known as Financing Linked Personal Subsidy Programme (more commonly also known as FLISP). The very first-time homeowners who will be currently making anywhere between R3,501 to help you R22,000 is also qualify for a little subsidy that will go on the expense of purchasing a property.

Is it possible you be eligible for home financing using one earnings?

Of numerous more youthful Southern Africans wishing to become homebuyers accept that owning possessions on one money is just not you’ll be able to. But not, centered on Adrian Goslett, Local Manager and you may Ceo of Lso are/Maximum off Southern Africa, inside the 2018, there were over 40 000 solitary ladies and over thirty five 000 solitary guys with currently ordered assets around the South Africa who’ll beg to help you disagree.

What other once-of will cost you should you decide thought to possess a home loan application?

When you’re obtaining home financing or even only seeking home on individuals costs, you can forget that price of your own residence is maybe not the sole prices that you ought to thought. Just in the event that you ensure that there is certainly room enough on your own month-to-month budget just after cost of living to purchase month-to-month thread money, but it is also essential to possess saved up adequate to pay the other upfront costs that come with to shop for a home, such as the relevant thread costs, import commitments and charges.