You can find around three authorities-protected mortgages on the market today. They’ve been called secured as the lender you to definitely produced the fund is compensated to possess region or all the losings should the loan actually ever enter foreclosure. A guarantee can frequently persuade a lender so you’re able to point that loan approval for an application that is sensed marginal. Provided the lending company recognized the borrowed funds with the correct acceptance guidance brand new make certain commonly implement throughout the longevity of brand new financing.

When you are this type of pledges is issued on lender, simple fact is that debtor one to pays brand new premium for these rules. There is upfront premium folded with the loan amount and discover yearly superior paid in monthly premiums.

The fresh new USDA financing belongs to the higher You Institution off Farming. The brand new USDA mortgage has been in of many variations and you can was to begin with named brand new Farmers Domestic Government mortgage. Earliest prepared back in 1946, brand new objective would be to help people that populate rural elements having glamorous financing possess. Later on during the 1994, this new USDA is chartered in order to manage the program.

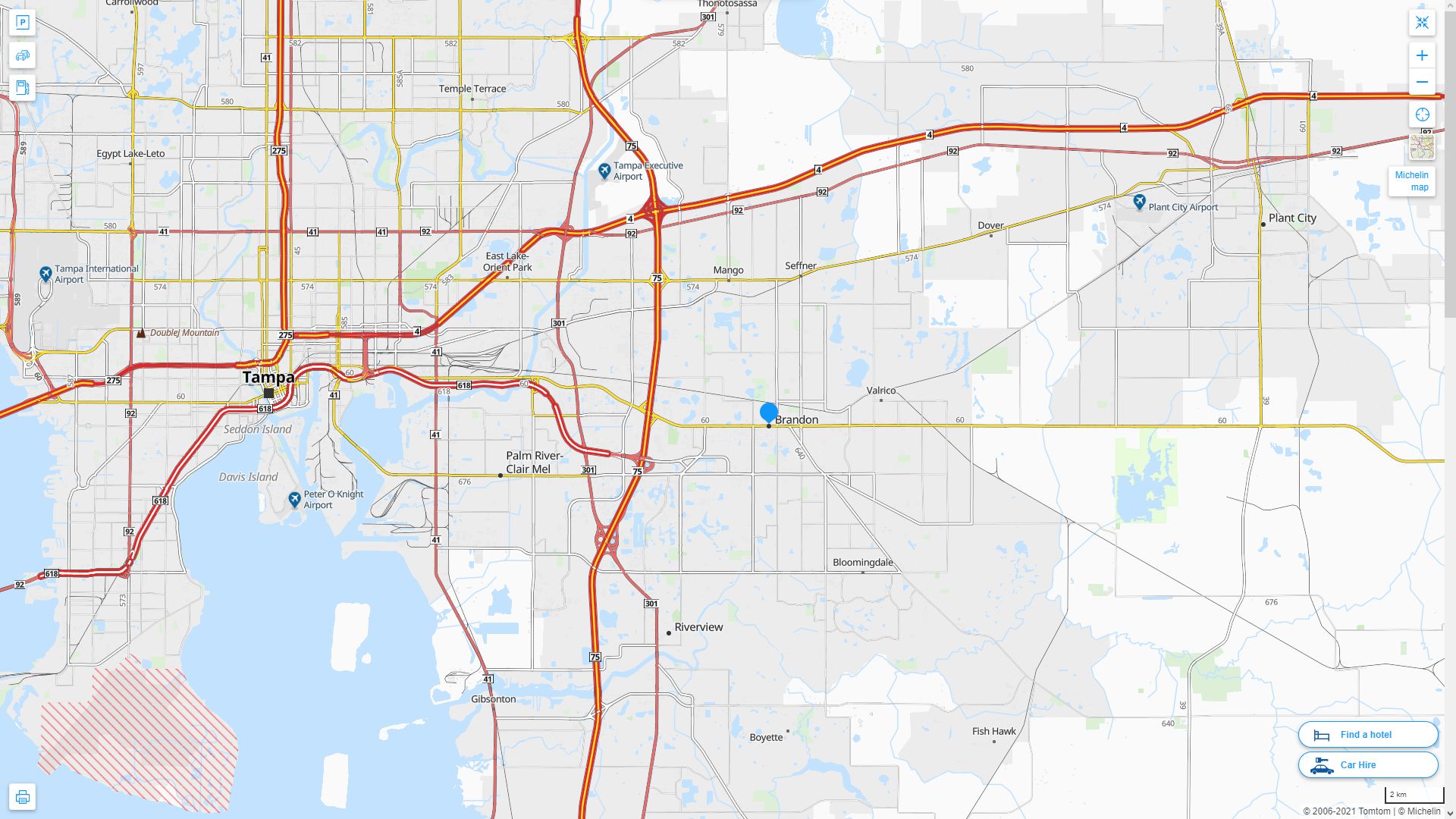

The latest USDA financing doesn’t need an advance payment and will be offering borrowers which have really aggressive prices inside the a 30-seasons repaired speed term. USDA loans usually funds property inside a rural or semi-rural city where antique financing was tough. Very old-fashioned loan providers now would like to loans a house into the an urban area in which discover similar homes in the neighborhood. Properties financed with a good USDA financing have to be situated in a beneficial pre-approved, rural town.

New USDA mortgage make certain means should the loan get into default, the lender try compensated at the 100% of equilibrium of the the loan. That it financing be sure was a kind of home loan insurance so there are a couple of such designs. An upfront premium is rolled toward loan amount and you can a keen annual advanced was paid-in monthly premiums.

FHA financing plus carry financing make certain. The latest FHA program is definitely widely known financing choice getting first-time people. There are a few, however, included in this is the low down payment FHA money wanted. Brand new advance payment specifications is simply step three.5% of the transformation rates. FHA finance is a while easier to qualify for. Minimal credit history particularly which have a down payment of step 3.5% is actually 580, whether or not lenders is wanted her lowest get and usually selections of 600-620.

There aren’t any limits from what located area of the possessions, such you will find getting USDA fund. For instance the USDA mortgage, there was an initial financial premium rolled into the financing amount and you may an annual one to paid back month-to-month.

FHA money are not booked to possess basic-time customers however https://paydayloanalabama.com/fairview/ they are often the basic alternatives

The very last bodies-secured mortgage is but one playing with guidance set forth because of the Institution away from Veteran’s Situations. The fresh new Va mortgage be sure was twenty-five% of one’s loan amount should the mortgage go into default. Of the three bodies-secured money, the fresh new Va financing is the high carrying out loan, despite the shortage of an advance payment. The fresh new twenty five% ensure is actually borne throughout the way Va financing limits were calculated. Whenever an experienced is applicable to own a great Virtual assistant loan, the lender upcoming purchases and you will get a certification regarding entitlement. Now, one to entitlement amount is actually $thirty six,000. The fresh ensure is actually four times the degree of entitlement the brand new borrower features. Four times $36,000 was $144,000.

Yet the limit Va loan formula has been a while dated and you can is later changed to mirror whatever the prevailing Compliant Mortgage Restrict are into area. Today, the most Va loan amount for some areas are $766,550, coordinating the brand new compliant maximum put of the Fannie mae and you will Freddie Mac. It restriction can change each year once the compliant limitations change.

Although not, unlike USDA and you can FHA loans, there clearly was only 1 sorts of mortgage insurance offering the be certain that towards bank and not one or two. Which have Virtual assistant money, the verify is actually financed of the Financial support Payment, that’s an upfront financial advanced that’s folded to your the last amount borrowed. There is absolutely no even more monthly financial top to own Virtual assistant money.

People who qualify for good Va loan are active obligation employees which have at the least 181 days of solution, pros of the military, Federal Guard and you may Military Reserve users with half a dozen or even more many years of provider and unremarried, thriving partners of them whom passed away when you find yourself serving otherwise since the a beneficial result of a support-associated burns off.

They are USDA, FHA and you will Va financing programs each is designed for a good certain types of borrower or condition

Please contact united states all week long with concerns because of the submitting the fresh Brief Request Setting on this page.