We do not provide capital internal. (Additional a couple of is Property and you can Laws, while you are curious). In terms of Small Domiciles, cash is naturally queen. For individuals who build it yourself and will select lots of salvaged thing, its likely that an effective you are getting by. This calls for you to definitely enjoys much time even when, and systems and a good gadgets. Some people be warmer choosing a professional Lightweight House-builder. A portion of these people could have $30-70k for the dollars they are able to set-up to own particularly property. Think about people who don’t? Anxiety maybe not, options are offered. Always keep in mind as well, in which you will find a can, there was a method. Why don’t we talk about specific you’ll be able to technique of investment a tiny House.

step 1. Friends/Family-You can see anyone that have bucks that would be happy to loan the money on a three to five season notice with an intention speed that may create well worth their when you’re, but really, perhaps not set huge unnecessary weight you, zero loan loans in Jacksonville expert, however, let me reveal some short mathematics. Can you imagine we should buy a little Household getting $35k. Hopefully you might setup $5k of your own cash. No matter where you have made financing, the lender is about to would like you to have some body on the games. You to renders a balance from $30k. Within 9% over 3 years, your own overall appeal was doing $4300. Which is a great return on the investment on the lender, and that is a little while highest for you, but it is not absurd. Like to see ridiculous? Just have a look at simply how much attention you’ll pay for a great 31 seasons financial for the a note only really worth $100k at 6% ($115, in total attention, if you should be interested)

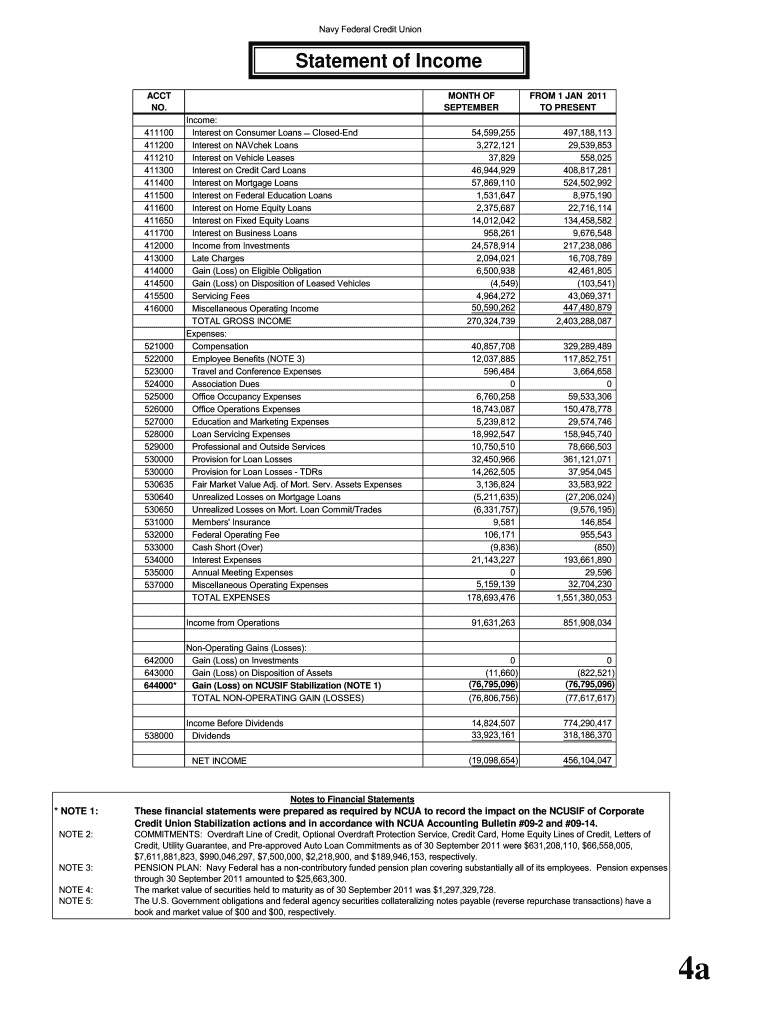

Local borrowing unions tend to have higher success costs over the mega banking companies

dos. Unsecured bank loan. Talking about difficult to get along with getting exceptional borrowing from the bank, but for particular it might be a choice. Talk to your regional bank and see for those who qualify. Yet another bank i’ve talked in order to and certainly will suggest try SoFi. Eligible borrowers can get personal loans for a couple of-7 years which have repaired and you may varying rates anywhere between 5-14%. A software to that bank does not ding their credit given that they do a great soft eliminate.

step 3. Covered financial loan- Do you have anything else totally free and you will obvious that would number just like the security into loan amount? Things like your car or truck, a yacht, bicycle, Rv, bicycles, other? Once again, talk to your regional bank.

It would be similar to providing a great used-car financing otherwise a personal loan when planning on taking a vacation or pay certain scientific expense or you never know just what otherwise

4. Rv mortgage- Some Lightweight Domestic developers are particularly RVIA formal as a means to offer a whole lot more gadgets utilizing Rv finance. We began the entire process of RVIA qualification, but withdrew predicated on a letter you to RVIA sent myself declaring its viewpoints against representing an item that has been planning to be studied since the regular traditions quarters, perhaps not briefly just like the an enthusiastic Camper is supposed to possess. Look for about it here. So, while you are handling a loan provider that needs a beneficial RVIA seal discover an Camper loan, I cannot help you in which regard. A number of developers had the foot regarding the home with RVIA before the letter hitting theaters, also to tell the truth along with you, I am not sure what the dynamics are there, but these builders will always be working offering RVIA certification. Should this be your only option, I am happy to refer your like a creator based on your own geographic area. Some claims commonly still allow you to sign in your own tiny home because a camper rather than a computer program trailer at the DMV. Either. combined with an automobile Identity Count (VIN) that most the brand new trailers have, this can be a fair coverage notice on bank in order to financing up against. Remember that yearly Rv subscription/fees is a lot greater than joining your own small household due to the fact a beneficial utility trailer