Here are some type of less than perfect credit lenders your may prefer to look, and the first standards you will have to fulfill. Allow me to share bodies-supported finance, meaning government entities means them and you may reduces the exposure to possess loan providers in case the debtor defaults. This will help to lenders give mortgages in order to individuals whom might if not endeavor to meet the requirements.

FHA home loans

Really lenders require borrowers for an effective FICO Score of 580 or more and you may the very least 3.5% down payment for it sorts of mortgage. However some loan providers will get undertake a good FICO Rating only 500 for individuals who bring a beneficial 10% deposit.

Va home loans

You do not have a certain credit score to be eligible for an excellent Virtual assistant mortgage. However, many loan providers wanted the very least FICO Rating with a minimum of 580 for this types of financing. Particular loan providers might only run individuals who have good FICO Get of 620 or more. New Service out-of Experts Items backs such loans to possess qualified energetic-obligation service users, qualified experts, and you will enduring spouses.

Virtual assistant fund ability zero down payment requirements, no individual mortgage insurance rates requirements, and limited settlement costs. Although not, such money would always function a funding fee.

USDA home loans

The new You.S. Company from Farming backs USDA loans and you will doesn’t enforce the absolute minimum credit rating criteria. But really lenders offering these funds put her recognition conditions and sometimes wanted borrowers for Fico scores regarding 620 otherwise higher to help you qualify for investment.

A separate perk regarding USDA fund would be the fact there’s absolutely no down payment criteria. you must get a house in a qualified rural urban area-so there is a living cover, too.

Your credit score doesn’t only connect with your capability so you’re able to be eligible for a mortgage. It can also impact the rate of interest a lender gives you on your financial. For this reason, because you could potentially qualify for home financing which have less than perfect credit (in a number of points) doesn’t invariably suggest it is advisable.

For those who have reasonable borrowing from the bank or less than perfect credit, you are able to likely pay a higher interest on your family financing if you’re approved for starters. A higher interest rate increases one another the payment per month and you will the level of total attention you have to pay regarding life of your loan.

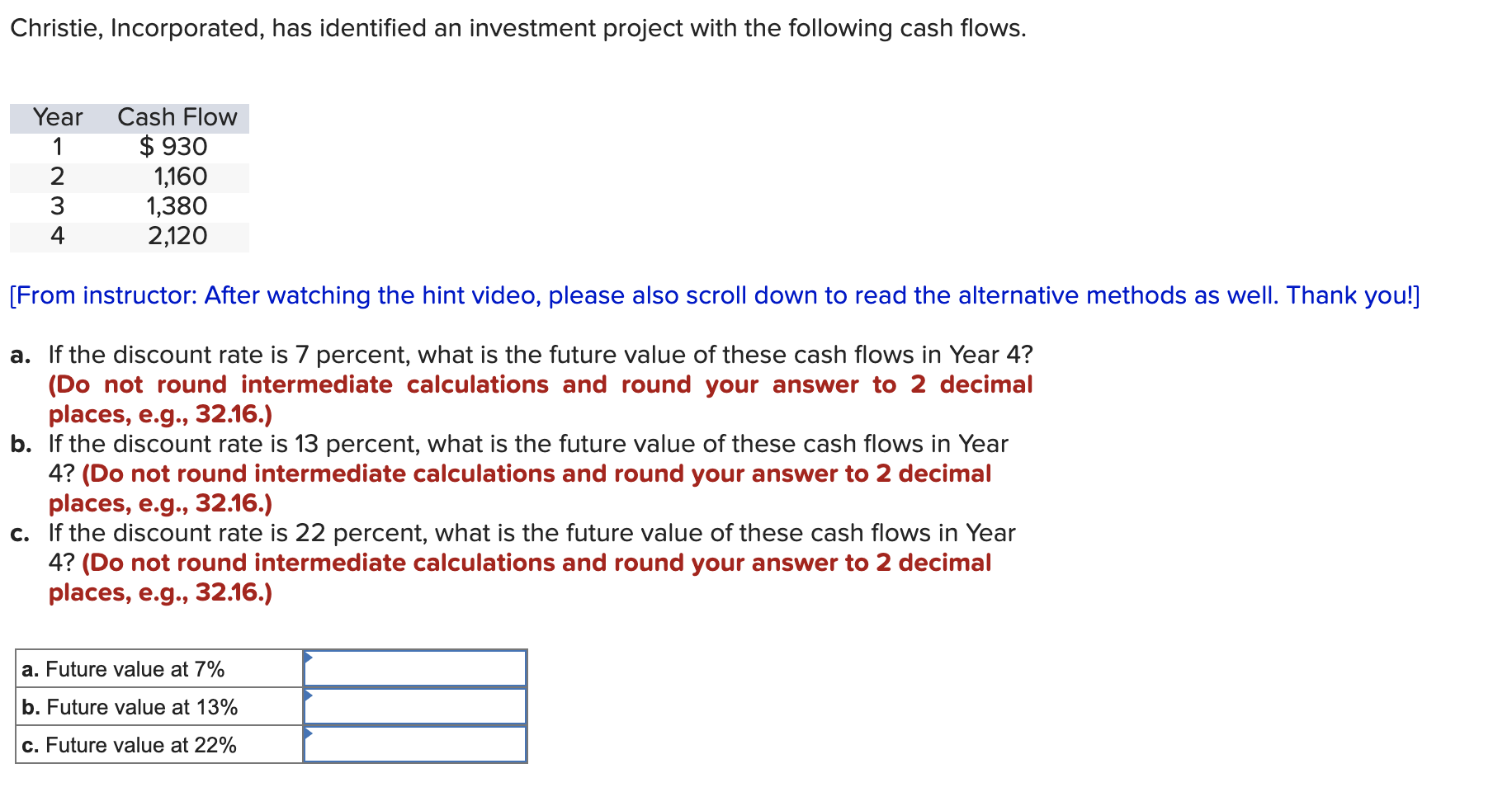

We have found a quote of simply how much poor credit you will potentially cost you in https://paydayloancolorado.net/sedgwick/ the event that a loan provider energized your increased interest rate on the a thirty-seasons, fixed-price home loan off $350,000 because of a poor FICO Score:

This type of quantity echo a price generated during creating having a good calculator offered by FICO. If you wish to plug their information inside and construct an even more customized and up-to-go out imagine, you are able to the internet myFICO Mortgage Savings Calculator to-do very.

Perhaps you have realized on the example above, with an effective FICO Rating regarding the lower assortment shown on calculator (620-639) may cost you a supplementary $377 four weeks on your own mortgage repayment compared to the anyone having a FICO Score out of 760-850 contained in this hypothetical. And you may, over the life of the borrowed funds, you would shell out in the a supplementary $135,773 from inside the attention-while you do not sold your house or refinanced the borrowed funds-than the a borrower which have a good FICO Score.

If you possibly could get it done, it’s a good idea to attempt to alter your borrowing from the bank before applying to own home financing to put on your own throughout the most useful status possible. But when you want to get on the home financing prior to attempting to replace your credit history, the following advice might help alter your odds of qualifying getting less than perfect credit lenders.