The Impact of Cryptocurrency on Global Finance and Society

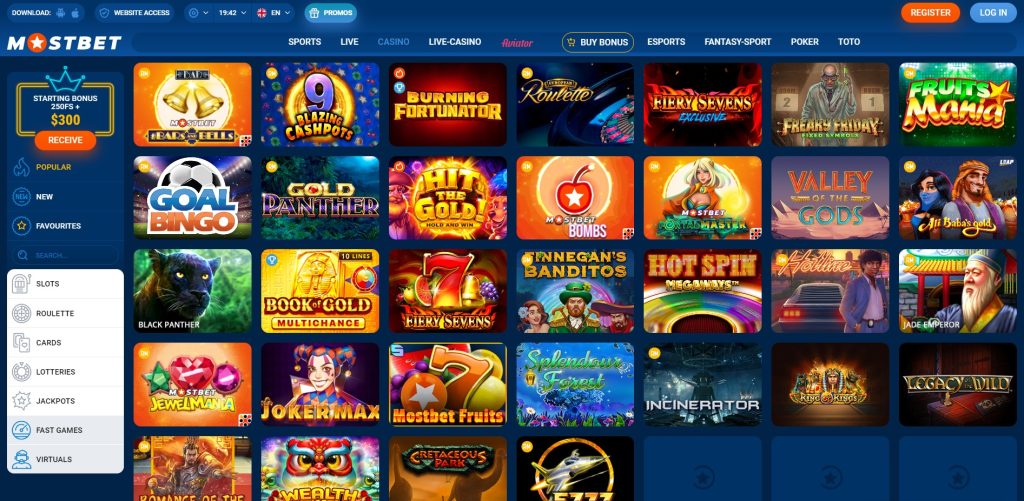

Cryptocurrency has emerged as a revolutionary force in the world of finance, technology, and society. Its decentralized nature challenges traditional financial systems, offering new opportunities and risks. Understanding the impact of cryptocurrency requires a look at its evolution, implications for global finance, technological innovations, regulatory challenges, and potential future developments. For those interested in exploring these dimensions in more depth, consider checking out The Impact of Cryptocurrency on Online Casinos in Bangladesh Mostbet লগইন for a unique perspective on integrating cryptocurrency into gaming and online services.

The Evolution of Cryptocurrency

The concept of cryptocurrency dates back to the late 1970s with the introduction of digital cash systems. However, it wasn’t until the advent of Bitcoin in 2009 that cryptocurrency began to gain significant traction. Bitcoin introduced the blockchain technology, a decentralized ledger that ensures transparency and security. Following Bitcoin, thousands of alternative cryptocurrencies or “altcoins” have emerged, each designed with unique features and use cases, ranging from Ethereum’s smart contracts to Litecoin’s faster transaction times.

Impact on Global Finance

Cryptocurrency fundamentally alters the way transactions are conducted, offering a decentralized alternative to conventional banking systems. One of the primary impacts of cryptocurrency is its ability to provide financial services to the unbanked population. According to some estimates, over 1.7 billion adults worldwide do not have access to traditional banking services. Cryptocurrencies and blockchain technology can facilitate peer-to-peer transactions, thereby enabling individuals in remote or underserved areas to engage in the global economy.

Decentralization and Financial Inclusion

Decentralization is a cornerstone of cryptocurrency. Unlike traditional financial systems controlled by governments and banks, cryptocurrencies allow for direct transactions between individuals without intermediaries. This aspect not only reduces transaction fees but also increases the speed of cross-border transactions. By leveraging blockchain technology, cryptocurrencies can offer financial services such as low-cost remittances and microloans, fostering financial inclusion on a global scale.

Challenges to Traditional Banking

The rise of cryptocurrency poses significant challenges to traditional banking institutions. Banks must adapt to the changing landscape, as more consumers and businesses turn to digital currencies for transactions, savings, and investments. Cryptocurrencies facilitate faster transactions and lower fees, which traditional banks often struggle to match. As a result, financial institutions are beginning to explore partnerships with cryptocurrency firms and integrating digital assets into their services.

Technological Innovations

Cryptocurrency has not only changed financial transactions but also spurred innovations in technology. Blockchain technology, at its core, allows for secure, transparent, and tamper-proof record-keeping. This innovation extends beyond finance into various sectors, including supply chain management, healthcare, and real estate. For instance, blockchain can enhance traceability in supply chains, allowing consumers to verify the origins and handling of products.

Smart Contracts and DApps

Ethereum introduced the concept of smart contracts, self-executing contracts with the terms directly written into code. This allows for automated processes without the need for intermediaries, reducing the potential for disputes and lowering transaction costs. Decentralized applications (DApps) are built on these smart contracts, creating a new ecosystem where traditional business models can be reimagined. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs), the possibilities are expanding rapidly.

Regulatory Challenges

While the growth of cryptocurrency presents numerous opportunities, it also raises significant regulatory issues. Governments around the world are grappling with how to regulate digital currencies, balancing innovation and consumer protection. Key concerns include combating money laundering, ensuring cybersecurity, and protecting investors from fraudulent schemes.

Global Regulatory Landscape

The regulatory landscape varies greatly by country. Some nations, such as El Salvador, have embraced cryptocurrency as legal tender, while others have imposed strict bans. The lack of a uniform global regulatory framework creates challenges for businesses operating in the crypto space, as they must navigate different jurisdictions and comply with varying regulations. As the market matures, it is likely that we will see more cohesive regulatory approaches that will help establish legitimacy and foster innovation in the cryptocurrency space.

The Future of Cryptocurrency

The future of cryptocurrency holds immense potential, but it also poses challenges that will need to be addressed. As more companies and institutions adopt digital currencies, we can expect increased mainstream acceptance. Financial giants like PayPal and Square are already diving into the crypto space, and institutional investments in Bitcoin and other cryptocurrencies are becoming more common.

Emerging Trends

Key trends likely to shape the future of cryptocurrency include the continued growth of DeFi, the rise of Central Bank Digital Currencies (CBDCs), and advancements in blockchain interoperability. DeFi aims to replicate and improve upon traditional financial systems by providing decentralized alternatives for lending, borrowing, and trading without intermediaries. CBDCs, on the other hand, are digital currencies issued by central banks, aiming to combine the benefits of digital currency with the backing and stability of central banks.

Conclusion

The impact of cryptocurrency on global finance and society is profound and multifaceted. Its ability to promote financial inclusion, challenge traditional banking models, and drive technological innovations underscores its significance in the modern world. While the regulatory landscape continues to evolve and challenges persist, the future of cryptocurrency seems promising. As we navigate this transformative journey, it is essential to consider both the opportunities and the risks associated with digital currencies, paving the way for a more inclusive and innovative financial system.