Being able to access and you will evaluating the HDFC Home loan report on the net is a beneficial easy process built to bring benefits and you will abilities. To possess HDFC Bank users, it business allows an easy overview of loan statements, guaranteeing they are up-to-date to their mortgage standing, as well as principal and you can interest areas, and will do its cash most useful. Its eg utilized for determining one discrepancies early and you may finding out how per payment influences the loan balance.

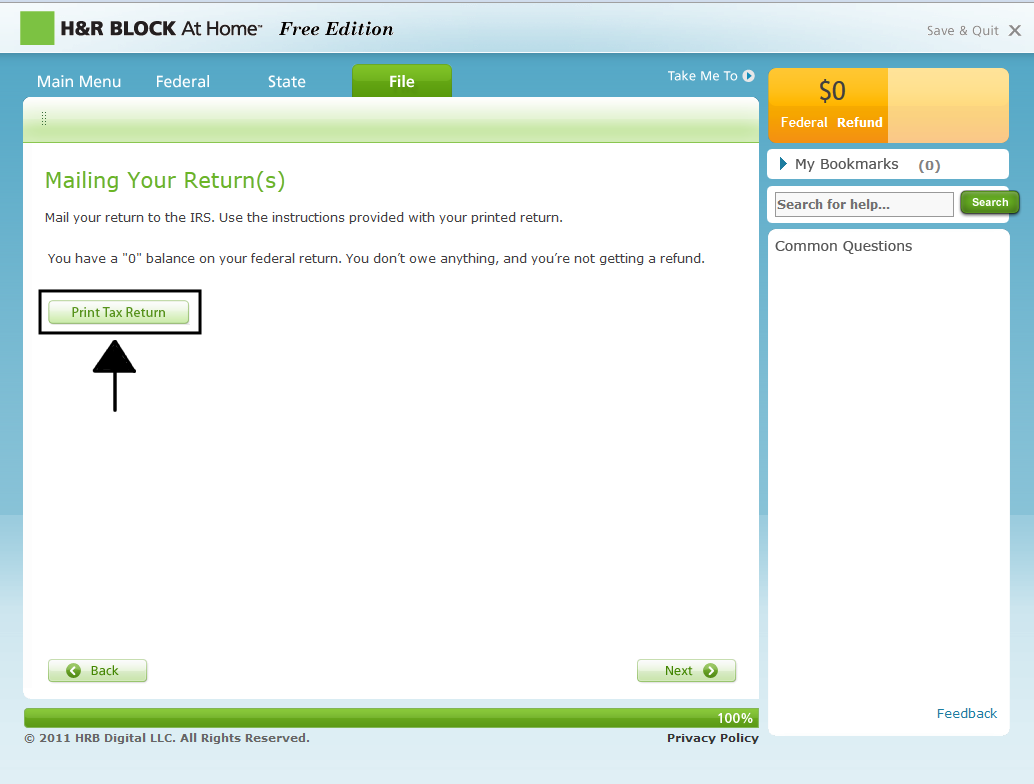

Furthermore, downloading the borrowed funds statement on the internet from the HDFC netbanking webpage is crucial for consumers trying claim taxation deductions. On loan statement available, users can merely seek out eligible taxation deductions under individuals parts of tax statutes, making it an important document for think and submitting taxes. The procedure necessitates the customer’s ID for a safe log on, making certain that the fresh owner’s monetary recommendations remains secure.

Knowledge The HDFC Home loan Declaration Online

Lenders also provide the desired let necessary to make the dream of running your property towards an accessible fact. Just after effortlessly taking a home loan it becomes essential for daily check up on your home mortgage comments. Insights your own HDFC Financial statement on the net is essential having handling your money effortlessly. It includes a detailed article on your repayments, featuring exactly how much of your own payment goes into the dominating number and exactly how far covers the interest. Which understanding is important to own believed income tax deductions and you may making sure you take advantage from your own taxation benefits as it among the many ideal benefits associated with taking a home loan.

What’s an HDFC Home loan Declaration?

A keen HDFC Mortgage report was a comprehensive document one to outlines the important points of your own financing, for instance the disbursement number, interest, installment period, and also the summary of for every single EMI. It plays a serious part in helping consumers tune the loan improvements and you can policy for tax deductions effortlessly.

Before you take for the home financing, it is important you do an intense plunge to your expenditures and have now a clear understanding of dominating amount borrowed and you will notice money. A great foresight in connection with this try figuring your monthly EMI’s having ideal monetary think. Of these planning put their houses on book also can below are a few that’s book fixed around lease manage act, having sensible decision making.

Ensure Your Mobile having Safer Accessibility

To be sure the security of your own economic suggestions, it is critical to ensure the mobile matter included in the HDFC Mortgage report supply procedure. This task functions as a safeguard, ensuring that just you have access to your loan declaration on the web. Immediately following confirmed, you’ll receive quick notifications and OTPs on your own inserted mobile, personal loans Illinois raising the defense of your own online banking feel.

The significance of Continuously Checking Your own HDFC Financial Declaration

Normal track of your HDFC Financial report is essential for staying near the top of your bank account. It helps you are aware the fresh personality of your loan installment, ensuring you might be constantly aware of the brand new outstanding equilibrium while the advances you’ve made to the complete cost. It vigilance is paramount to handling the income tax deductions effectively, as it enables you to choose eligible write-offs and you will plan your own cash correctly.

The way it Facilitates Managing Your bank account

Keeping a virtually eyes on your own HDFC Financial statement helps within the ideal monetary thought. Of the focusing on how your instalments is actually assigned amongst the prominent and attract, you may make told decisions regarding your loan prepayment otherwise restructuring when needed. This knowledge try priceless for optimizing income tax write-offs, whilst allows you to leverage maximum you can experts, ergo cutting your taxable income.