Toward expanding surroundings regarding financial possibilities inside the Ontario, its necessary to comprehend the different varieties of lenders accessible to prospective property owners.

Going for ranging from private and you can antique lenders is a huge step on your go homeownership. This short article leave you an obvious glance at both, so you’re able to select the solution that suits your needs ideal.

Do you know the Great things about Using an exclusive Financial As compared to a vintage Lending company?

Here’s the thing about personal loan providers-they truly are flexible. In the event the borrowing score’s become on an excellent rollercoaster ride, the salary is not the same month to month, otherwise if the bankruptcy’s a phrase on the modern times, individual lenders were there to meet your where you are. They truly are about in search of financial choices that fit your unique facts.

And there is another advantage-price. Which have smaller red-tape in order to navigate, individual lenders will processes apps faster than simply old-fashioned ones. So, in the event the time’s of one’s substance, going individual might get your you to mortgage acceptance reduced.

Traditional loan providers, including banking companies and borrowing from the bank unions, commonly rather have consumers that have solid fico scores, secure revenue and you can a powerful reputation of economic duty. Although this will likely be beneficial for such as someone, this may exclude individuals with monetary hiccups. And here private lenders can be found in, connecting this new gap and you will providing mortgage possibilities having a greater range out of borrowers.

What Standards Should one Imagine When choosing Ranging from Private Loan providers and Antique Mortgage lenders?

- Credit rating: When you yourself have a powerful credit score, a traditional financial might provide you with most readily useful rates. Although not, in case your credit score are sub-standard, a personal lender can be more likely to accept your financial software.

- Money Balance: Conventional loan providers have a tendency to need proof secure money. Simultaneously, individual lenders are usually even more versatile and can manage mind-employed somebody or people who have fluctuating income.

- Price regarding Acceptance: If you would like quick approval, individual lenders usually process applications reduced than old-fashioned lenders.

- Mortgage Mission: If you are searching to order bizarre characteristics, including brutal belongings or commercial home, private lenders might be a whole lot more amenable.

Exactly what are the Fundamental Differences when considering Personal and Conventional Lenders?

![]()

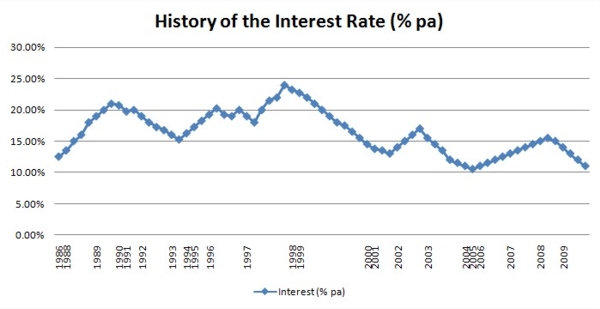

An important differences between individual and you can old-fashioned mortgage brokers rotate up to financing conditions, financing running rate, flexibility, and you can interest rates.

Conventional lenders are more strict out of lending conditions, place extreme focus on credit ratings and you will earnings stability. They could likewise have lengthened loan approval procedure along with their rigorous bureaucratic formations. not, sometimes they promote all the way down interest levels to the people who fulfill the conditions.

Private loan providers possess a new approach. These include generally even more versatile with the requirements, making them a chance-in order to just in case you will most likely not fit the standard mildew and mold. Rate is additionally on the top – Fort Garland payday loans no bank account they often agree money a lot faster.

What sets private loan providers apart is their concentrate on the property’s well worth in lieu of your credit history or earnings. In a busy city, the loan Broker Shop may provide as much as 75% of your own property’s well worth, meaning you can get that loan off $750,000 towards the an excellent $step 1,000,000 possessions. In quieter, rural components, they generally give around 65% of one’s property’s well worth.

Is-it Easier to Qualify for home financing from a personal Bank than simply a traditional Lender?

In some instances, yes, it could be easier to qualify for a home loan of a private bank. As they are faster controlled than traditional loan providers, private lenders have more discernment inside their financing standards, making them a feasible option for borrowers with exclusive financial facts. They’re able to search beyond fico scores and you will earnings balances, concentrating on the value of the property rather. As long as you try not to exceed the mortgage restrictions to own private lenders (75% having metropolitan properties, 65% to possess outlying) it is easy to get approved.

Yet not, it is essential to note that “easier” cannot always suggest “finest.” If you are private loan providers may provide an even more obtainable path to securing a home loan, they often fees high interest rates in order to counterbalance its chance, which could bring about highest overall will set you back.

Where to find Reliable Personal Lenders?

- Research: Begin by a general lookup and you will restrict your options dependent on your own particular needs and you will situations.

- Recommendations and you will Testimonials: Identify analysis and reviews regarding earlier in the day clients to guage its expertise in the lender.

- Transparency: Legitimate lenders will be transparent about their terms and conditions, fees, and rates.

- Professionalism: A beneficial loan providers maintain large requirements out-of reliability, providing clear and timely interaction.

- Licenses and Accreditations: Make sure the lender was subscribed and you may accredited by related monetary bodies.

- Consultation: Talk to financial advisors otherwise knowledgeable brokers locate expert views and you will guidance.

Navigating the fresh new landscapes away from financial credit might be complex. The possibility between individual and traditional mortgage brokers depends greatly to your your unique finances and personal choices. Traditional loan providers may offer lower rates of interest and you can standard credit possibilities, but their stricter criteria can be restriction accessibility for most consumers. Likewise, individual lenders also provide flexibility and you may rates however, usually at the high rates of interest.

In the two cases, it’s crucial to understand the terms of the financial agreement carefully. And don’t forget, much easier usage of financial acceptance doesn’t necessarily equate to a better monetary decision. Usually weighing the expenses and you can benefits associated with per option meticulously, guaranteeing the mortgage solution aligns along with your much time-identity financial requires.

For more information regarding the private mortgage brokers in the Ontario, you can check out the mortgage Representative Store webpages to have inside-depth understanding and you can recommendations.