Domestic when you look at the to your HUD

The original place to select offer help is HUD. Whilst the agency alone will not build has to prospects, it can grant finance earmarked to possess very first-time homebuyers to help you communities that have Internal revenue service taxation-excused reputation. The new HUD site have information.

Turn-to Their IRA

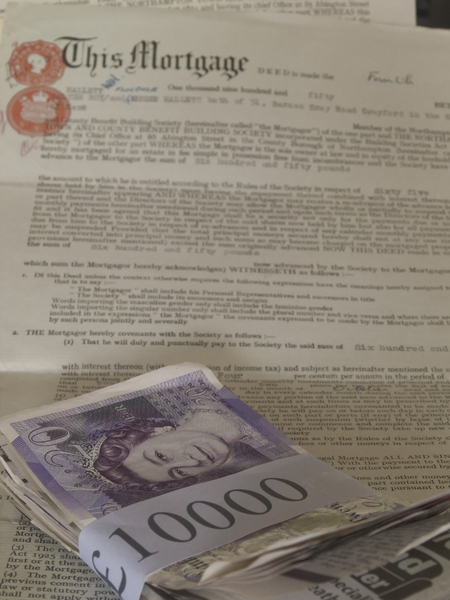

Every very first-date homebuyer is approved when planning on taking as much as $ten,000 out of collection money away from a classic IRA or Roth IRA without paying this new ten% penalty for early detachment.

The latest IRS’s definition of an initial-date homebuyer was an individual who hasn’t had an individual quarters inside the a couple of years. (Note that this can be distinct from HUD, which takes into account a primary-big date homebuyer as an individual who hasn’t had a personal household within the three years.)

Thus even although you possessed a home on the earlier, you may be eligible to faucet this type of finance to possess a deposit, settlement costs, and other associated expenditures for individuals who meet up with the federal standards, indexed Dean Ferraro, a representative registered so you can represent taxpayers until the Irs (IRS).

Because that punishment-totally free $ten,000-lifestyle detachment is for every single individual, one or two you’ll withdraw a total of $20,000 (from their independent IRAs) joint to cover the earliest home. Attempt to make use of the money inside 120 months, otherwise it does feel at the mercy of the fresh new 10% punishment.

The initial-date homebuyer different just exempts you against the fresh new 10% punishment. You will still need to pay tax to the currency you withdraw regarding a classic IRA, but Roth IRA profile commonly subject to extra taxation.

Proportions up-state Applications

Of many claims-instance, Illinois, Ohio, and Washington-render advance payment guidelines to own first-time homeowners whom be considered. Generally, qualifications on these applications is founded on money and could limit https://simplycashadvance.net/personal-loans-wv/ the price of the property purchased. Those who are qualified is able to discover financial help that have down costs and you may closing fees along with costs to help you treatment or increase property.

Understand Local American Options

“Beside the zero-money-down Va mortgage, this is actually the ideal government-backed mortgage provided,” states Ferraro. That it mortgage means a-1.5% financing upfront make sure commission and just a 2.25% down-payment towards fund over $50,000 (for finance less than one to matter, it’s step 1.25%).

Unlike a traditional loan’s interest rate, and this can be in accordance with the borrower’s credit history, that it loan’s speed is based on the prevailing markets rates. Area 184 fund can just only be used getting unmarried-members of the family house (one to four devices) and you will top homes.

Feel out of the Feds

When you find yourself games for good fixer-higher, the new Federal National Mortgage Association’s (FNMA) HomePath ReadyBuyer system is actually geared toward basic-time consumers. Just after finishing a mandatory on the internet homebuying training path, professionals can located around step 3% in conclusion rates guidelines. The help goes toward to find a good foreclosed possessions belonging to Fannie Mae, while the FNMA is actually affectionately recognized.

Other federal or bodies-paid enterprises give apps and you may guidelines one to, however exclusively for basic-time people, favor those with less money available for off money, or restricted credit score. Best-understood of the is Government Housing Administration loans (FHA finance) and you will Service of Veterans Products financing (Va funds).

Tax Experts for all Homebuyers

To shop for an initial household plus enables you to eligible for the new tax masters afforded to each homebuyer, if or not these are typically on their first or 5th home.

Mortgage Appeal Deduction

Mortgage focus was previously one of the greatest deductions in the event you itemize. Although not, brand new Tax Slices and Jobs Work (TCJA) has minimal it deduction on the desire paid to the $750,000 or less ($375,000 or shorter for these hitched submitting separately).