Have you been care about-working otherwise 1099/separate contractor and curious for people who qualify for a mortgage? Well you don’t need to proper care or ponder, Babak possess your protected.

B Squared Financial support Home loans understands that we have all some other economic need. That’s why you can expect Non QM Mortgage loans to help individuals get the home they need, whether or not they won’t meet the requirements away from a normal financing. Babak is seriously interested in trying to find you the best financial and obtaining your dream family out of on the right ft. Babak has arrived to aid!

Benefits associated with a low QM Financing

Small businesses and you may 1099/independent builders, provides exploded lately. Recording consistent income supplies might be an issue. Non QM fund work nicely having notice-functioning and you may 1099/independent builders as lenders could possibly offer which financial merchandise that can also be reduce limitations.

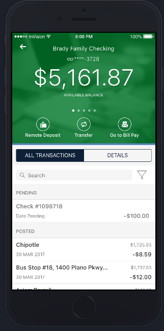

Consumers who do perhaps not otherwise cannot tell you enough earnings can get pick Non QM. Self-employed and you may 1099/independent specialist borrowers usually have this problem. Such as, if you focus on a cash basis, you need to use your bank account in order to offset the insufficient income (just how its computed may differ). Usually, it’s not necessary to render taxation statements or pay stubs, and you may advancing years levels (having constraints) can even be used.

The new Low QM home loan isnt crappy, its a means for choice lenders in order to participate to possess money finance getting borrowers maybe not entitled to conventional otherwise government-backed loans.

- Brand new FICO credit score diversity was 620-840

- A credit rating no less than 620

- Features secure money with a minimum 24 week background

- A great debt-to-earnings rates

- Have enough cash reserves

Just how a non QM Financing Performs

Fundamentally, Low QM funds are provided to those who don’t meet the standards getting Federal national mortgage association and you can Freddie Mac financing. Usually small enterprises and you can mind-working and you can 1099/separate builder borrowers are great applicants having Low QM finance.

Low QM funds features slightly large interest rates than simply antique mortgage loans, cash loans and payday advances however they are prone to become recognized if not meet the requirements to have traditional finance.

Are Self employed/Non QM Finance Right for you?

Here are ways to probably the most frequently questioned home client issues. While the a next thing, Babak can assist you in selecting the most affordable home loan.

For individuals who recently completed a spending plan, Babak desires see it. There are numerous resources available on the net along with printing which can let would a realistic family funds. Do not getting shy on the sharing details such as the monthly book or mortgage payment on the present family, any current charge card balance, most recent insurance, or any other costs.

With this particular suggestions, Babak can help you determine the to shop for strength and you will direct you towards the house financing bundle that is right to you personally.

To help you qualify for a non QM loan, this new borrower need to have a minimum credit score from 620 and you will no less than six months of toward-go out costs.

The new borrower must also keeps a somewhat stable earnings and good financial obligation-to-money rates, also adequate dollars supplies. If not see these types of criteria, Babak work to you to obtain the prime services to own your.

A non QM mortgage loan is a kind of financial that really needs all the way down documents and you may credit rating than just a normal financial.

For example, in the place of earnings otherwise advantage documentation, a non QM financing might require the debtor to demonstrate facts that he or she enjoys a sufficient credit history, possess regular work for around couple of years, and you can a fair debt-to-earnings ratio.

Low QM loans was a type of mortgages which might be felt getting an alternative to a timeless financial. The usa mortgage industry has been reigned over because of the both Federal national mortgage association or Freddie Mac computer, however, forex trading features opened some other loan providers about past lifetime.